negative Review of Micah Ball, Attorney, Greenville, NC

A review of the evidence on this webpage will clearly show Micah Ball of Columbo Kitchin is incompetent and/or corrupt and more likely corrupt. Micah Ball, Greenville, NC attorney represented Plaintiff Carter Smith in a case against Defendant Charles Smith (the author of this page) in Beaufort County North Carolina Case 16-CVS-471. North Carolina General Statute 1A-1 Rule 11 makes it a duty for an attorney to make reasonable enquiries about the truth about an filing before he files a claim. An attorney should do this not only so a baseless suit is not filed against someone, but also he should not want his client to believe that the client is likely to prevail in court, and it certainly reduces the chances of prevailing on in court on other issues when it is obvious that the attorney has no credibility with a major part of his case.

Claim One: Forgery on Opening Joint Bank Account

In this case, Micah Ball alledged that Ruth Waters had her signature forged on a joint account that was opened with Charles Smith, her son in May of 2007.

My Reasoning and The Evidence

I believe that Micah Ball and his co-counsel clearly not only violated Rule 11, but in addition Micah Ball along with a handwriting expert Durward Matheny, his client Carter Smith, and his co-counsel Andy Fitzgerald have attempted to defraud me as they knew the evidence was false.

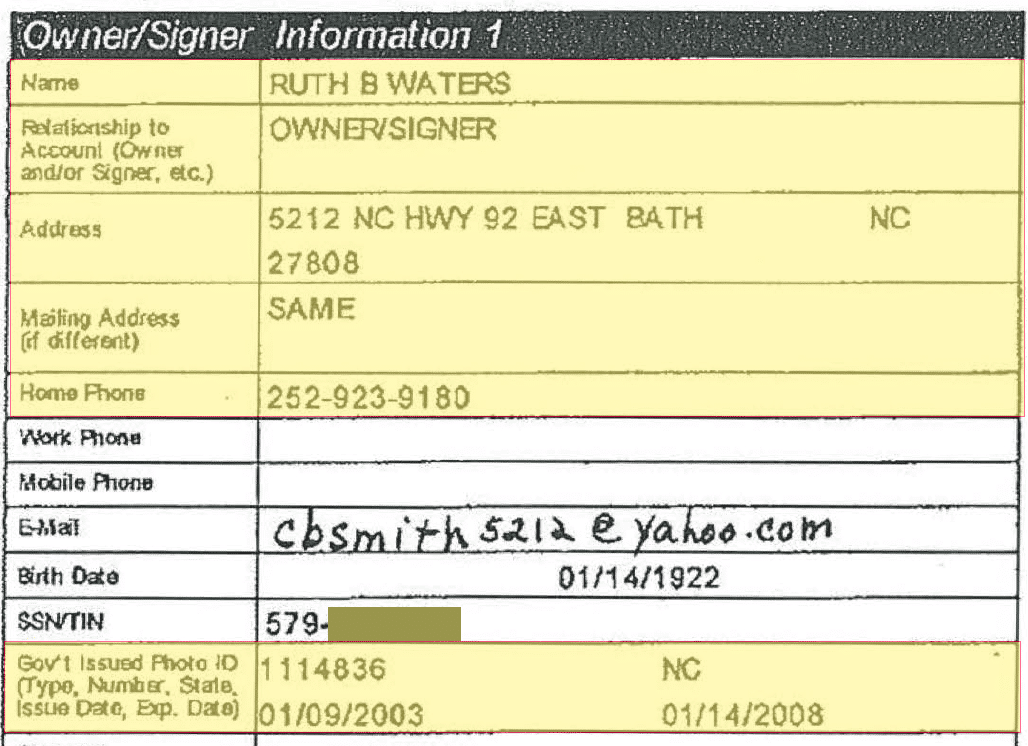

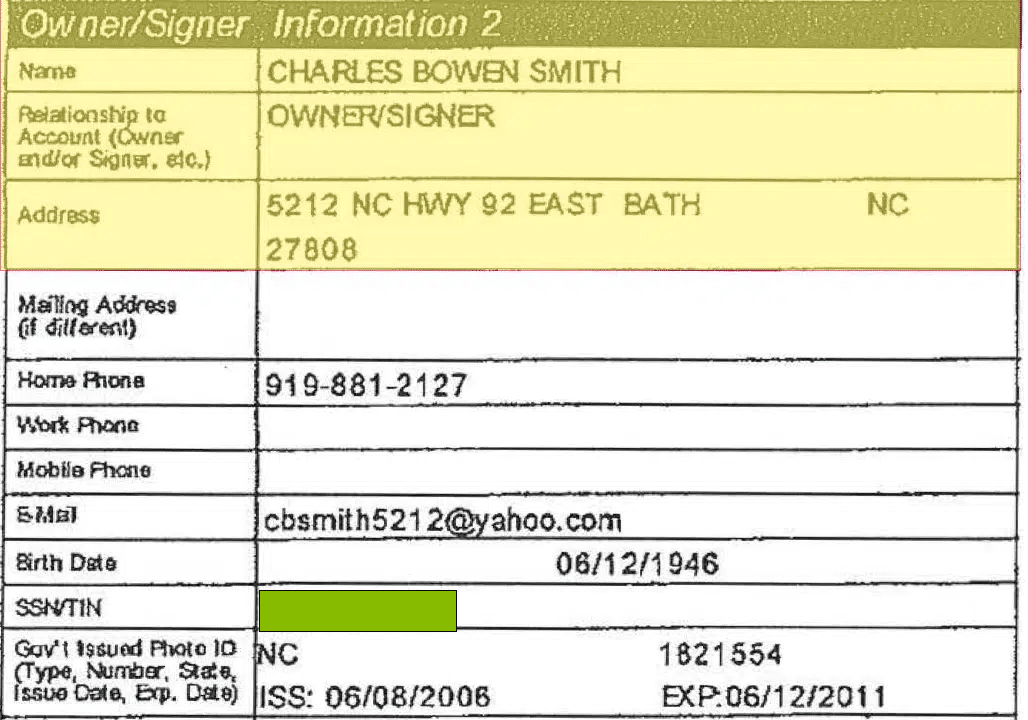

Micah Ball representing his client Carter Smith received papers showing that my mother Ruth B. Waters had opened a joint bank account with me, and she had also signed a lease agreement where she directed the lease payments to be paid directly to me. He decided to send these agreements to a handwriting expert to determine if my mother’s signature had been forged. (Pages 1 and 2 of the evidence files below)

Micah Ball and his client take a document that was signed in May 2007 and first ignore that for me to submit a forged document to the bank that I would be committing a felony, and also risk that my mother would find out that I had forged her name and destroy her faith in me. She had demonstrated that she did trust me my giving me a power of attorney earlier in 2007. She did not die until December 24, 2011. Is it likely that she would not have noticed the account being opened for over four years and not have minded that I forged her name to open it?

I have searched the internet and I have not found a single case where a bank allowed someone to open a joint account with a forged signature. There are lots of cases of someone forging checks, but not one where someone forged an account opening form. One would think banks would not take any chances as allowing someone to sign up this way without absolute proof since that would allow all of the assets from the victim to be stolen and the bank would be totally responsible. This is why probably every bank all have something like the block below showing what photo ID was used to open the account (bottom block of image below). If Micah Ball really believed that the signature was fradulent, he should have sued the bank. He would have had much better chance to get the $1.9 million he claimed disappeared from a big bank than me.

Is it likely that Micah Ball really thought that I had forged her signature three times on the document and would take such a risk to commit a felony and risk being written out of the will and displeasing my mother?

If one were to do such a thing, it would only make sense to hide it until a short time before my mother’s death and then use the account to my benefit. It was more than four years later that my mother died, and Micah Ball knew that I had not been disinherited or had my POA revoked. Is it likely that Micah Ball thought anyone would put the victim’s name as the primary on the account so she would get any mailing about the account and that anyone would list thier mailing address as the same as victim’s address as shown below?

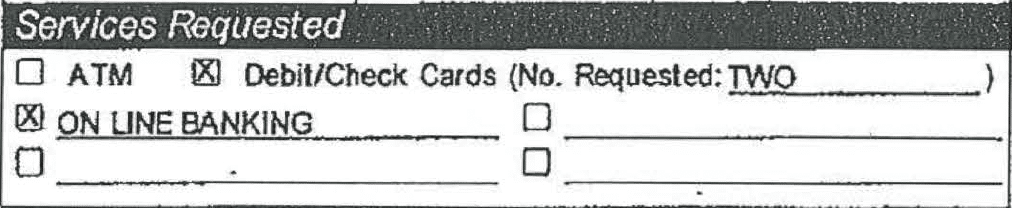

Is it likely that Micah Ball was so stupid that he would think that I would request two credit cards which would be mailed to my mother’s address?

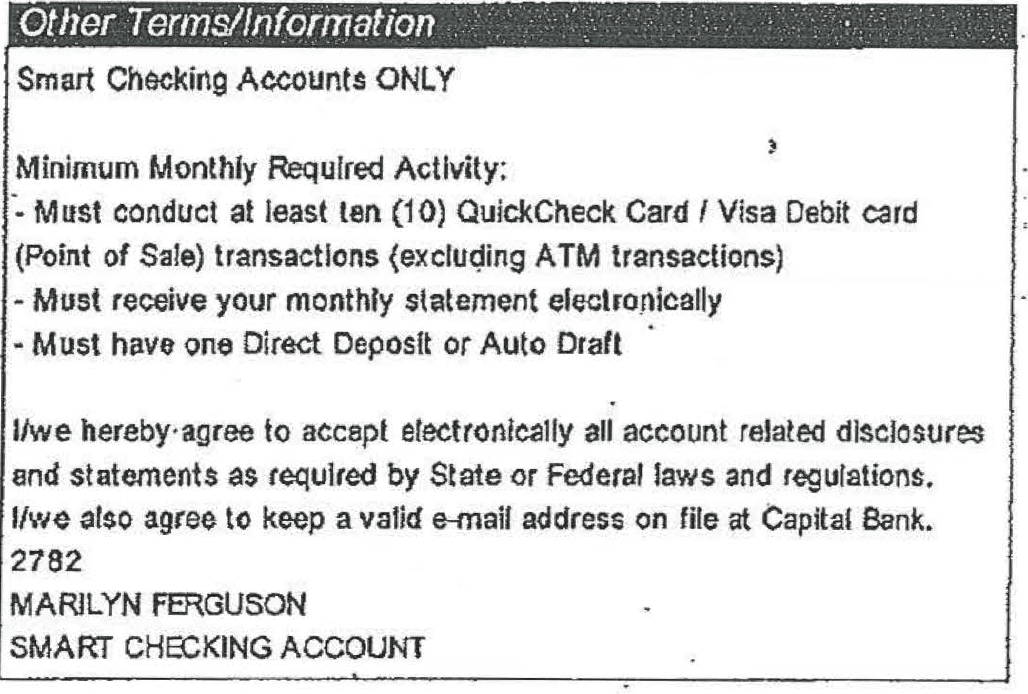

Is it even possible that anyone who is opening a fraudulent account would request to open an account that the debits cards needed to be used 10 times a month and some monthly automatic payment or withdrawal would have to be made since this eliminates the possibility the person is going to be unaware of the forgery.

Is it likely that Micah Ball who claims to specialize in estate law would not recognize that $24,000 is exactly the amount which someone can open a joint account with someone else and not be required to file a gift tax return. be believe that that he really believed that I, who was not on the other account with my mother was able to take $24,000 from that account and open that new joint account. First, it is unlikely the bank is going to allow that since I would not be authorized to do that and second, is there any way my mother is not going to realize that I have taken $24,000. Why start an account with $24,000? That is the exact amount that someone can open an account with someone else and not have to report gift tax. Carter would have know that Mother had opened a joint account with her so is it logical that she would possibly think that my mother would not have done the same for me since I was in her will and Carter was not. By at least October 26, 2018, Micah Ball also knew that my mother later opened a joint account with Carter and the opening deposit was $24,000 (page 63). They never dropped the contention that the document was forged despite all of this being known to them. In addition, Carter had received other gifts of $12,000 ( Page 65) which was the maximum amount that Mother could give without reporting gift tax which makes it possible to open a joint account for $24,000 without having to file a gift tax report. I do not think it is realistic to think that Micah Ball did not discuss sending these documents to the handwriting expert Durward Matheny, and I cannot believe any jury or reasonable person can believe there would be any point in doing so as the only possible outcome with a real handwriting expert would be that he could not tell if the signatures were legitimate, or the signatures were legitimate. Is it possible that Micah Ball could also be so stupid as to think the account document was forged when the credit cards were being used almost entirely in Washington and Greenville the very next month after the account was opened, and not in Raleigh which was my home (pages 8-24)? Is it likely that Micah Ball felt that the document was forged even after he got the statements showing that all the initial checks on the account were written by my mother and not me? In my deposition when I was asked about the handwriting expert, I answered that he must be an idiot. I also suggested that he subpoena the video recording for that date from the bank, and that I was sure that it would show my mother in the bank. He responded that doing that would be a something for my attorney to do (pages 55-60). Does it make any sense that a competent lawyer would want a major part of his case blow up in front of a jury? Does it make any sense that if he believed that I had forged my mother’s signature that he would not immediately try to get such evidence which would destroy my arguments. I am also sure that Carter would have read my deposition, and also, if she had any belief that I really had forged those signatures, would have insisted that Micah Ball try to get visual evidence that my mother was not there. In addition, in the Durward Matheny report, he states that he could be absolutely sure if he got more samples. This appears to me to an attempt to cover his bases about making a claim that he knows is wrong, but it also shows how unethical Micah Ball is because he later had many more samples of Mother’s handwriting come into his possession. In which case, he either did not send them (unethical) or he sent them and did not report the results (again unethical).

This shows how unethical Micah Ball is. First, going into court knowing that you are going to lose a key part of your trial is not good strategy. A jury is not going to look kindly on plaintiffs who are making such stupid claims that the jury is going to realize are bogus. Second, he also screwed his client by making it difficult for me to reach any settlement when I realized they are unethical and just trying to extort money. It is hard to decide to give money to such people.

Claim 2: Forgery of Lease Agreement

As far as the lease agreement (Pages 68–70) which the handwriting expert also said that highly probable had been forged, he again took the handwriting expert’s word without so much as a phone call to the other party who remembered watching Mother sign the agreement. Is it likely that Micah Ball thought that I would forge her signature on such a document when in a town as small as Bath, she is most likely going to run into the other parties who would thank her for allowing the transfer from father to son if they were not at the signing. Micah Ball also had access to the previous lease agreement (Pages 71-73) that show that the agreement is substantially the same except the second agreement does include some income for Carter after the ten year period which the first agreement did not. Does it seem more likely that Micah Ball just overlooked all this information or that he actively created this evidence. If Micah Ball had somehow realized that these documents were not forged and if he were ethical, then he would have dropped the claims. He did not ever drop these claims which demonstrates again that he is unethical enough to have conspired with the handwriting expert and Carter to manufacture false evidence.

Claim 3: Misrepresentation of Land Value

Micah Ball tried to claim that I had misrepresented the value of land that had timber on it. This was despite the fact that he had access to the letter to Carter’s previous attorney David Francisco stating that the land would be evaluated without regard for the timber, and they could get an estimate from the Stephen Tucker or any other timberman that hey chose. Micah Ball actually had me read the two different places in the appraisal that explained that the appraisal did not include the timber value (pages 84-86 of evidence below) so he had to know that Carter and her attorney David Francisco got correct information from me, and I assumed that an attorney and his college graduate client who also graduated from the School of Math and Sciences would know how to read. I also sent an email to David Francisco that explained exactly why the appraisal was to be done without the timber value included (pages 82 and 83 of evidence). This was thrown out by summary judgement from the judge and upheld by the appeals court.

Claim 4: Money Transferred To Joint Account

Micah Ball got an accountant to exam the financial records of my mother who died in December 2011 back to 2007. The accountant said he could not account for nearly two million dollars. If one actually added up all the money that could be traced to me, my family, my family, and businesses which I had ties with, the total amount was only about $284,000. Despite introducing no evidence of my mother being incapable of managing her affairs, they tried to put all of this money back into estate so it would have to be split with Carter. For example in May 2007, Mother opened a joint account with me and the opening amount was $24,000. That money was part of the $284,000. Fifteen months later, Mother opened a joint account with Carter who was not even in her will at the time with $24,000. The claim was that the $24,000 to me should be put back into the estate, but Carter’s money should not be so Carter should get another $12,000 from me. The claim at trial was that any money that went from Mother’s account into the joint accout with me should be split with Carter. For example, $12,000 that came for Mother’s individual account into the joint account which was then sent to Carter’s joint account so she could put the money toward buying a car would mean that I should owe Carter another $6,000. Fortunately for me, the jury was much fooled by such phony math. Keep in mind, that Carter was not even put back into the will 10/8/10 and fully recognizes that Mother was full competant at that time to write a will, but somehow knew nothing about money being used in the joint account up until that time even though it was the account that she had to use the debit card 10 times a month. She also seemed to think mother was aware of things in early 2011 when she called Mother about how her car had broken down and I called Carter and explained that Mother wanted me to transfer $12,000 to her joint account so Carter would be able to buy a new car. Is it more likely that Micah Ball and Carter Tankard Smith both thought that I should have to pay Carter another $6,000 or were they just trying to steal money?

Micah Ball admits malice

On Micah Ball’s website, he claims to specialize in tax and estate issues.

But he allowed his client to lose over $100,000 and admitted that he was acting adversely towards me instead of acting in the best monetary interest of his client. Admitting that he was acting adversely towards me as executor of the estate which was in his client had a 50% interest demonstrates clearly that he and his client were behaving with malice which is one of the criteria that can justify punitive damages in a counter suit. The following is from an email dated 5/9/2016 which explains how them not working with me resulted in Carter suffering such a large loss. This is primarily because estates do not benefit from being able to get a long term capital gains rate, but are taxed at a flat 40% federal income tax rate so if the estate gets property that is appraised at $60,000 and your cost basis is only $10,000 and the land is only worth $20,000 then the estate would have to pay 40% on the gain which would be $20,000 which if the land were sold later at $20,000 would net you nothing and you would still owe state taxes. The text below is from an 5/19/16 email to both Carter Tankard Smith and Micah Ball that explains how much the unwillingness to work with me cost his client.

“I have consistently explained to Carter and her legal representatives that I believed that the eight lots that the estate got in the Bridgewater South settlement were vastly over valued by the appraisal, and that there would be adverse income tax consequences if nothing were done. The value from the appraisal for the eight lots was approximately $340,000 which I felt the actual value per lot was probably between $20,000 and $25,000 each or a total of $160,000 to $200,000, but it could take quite a while to sell the lots at this price. I felt the estate would be much better off to sell these lots to Carter at $15,000 each (or anyone else) as the income tax savings would offset the price differential. If Carter had purchased the lots for $15,000 each, I could apply the tax loss of approximately $221,000 against gain from Bridgewate South, and the estate would most likely have no income tax due. Carter would have spent $120,000 which would go into the estate which she would be entitled to $60,000 back. Carter would have $60,000 invested, but own $150,000 minimum worth of real estate. This would have been much better than have $150,000 worth of real estate on which $100,000 of taxes are due on which would net Carter only $25,000. I have not included penalties and interest just to keep it simple, but at a minimum, this seems to have cost Carter $65,000. If she were able to sell the lots for $20,000 instead of $15,000, she would pick up another $40,000.”

Since the land was later able to be sold for $20,000 per lot, this did cost Carter Tankard Smith over $100,000. This also points out that his client acted with malice because she continued to keep Micah Ball as her attorney despite costing her this much money.

In an email from Micah Ball to me on 5/23/2016, he included the following:

You will recall that in my e-mail to you dated May 10th, I advised you that my representation of your niece, Carter Tankard Smith, was adverse to you. Therefore, I am not representing you or the estate. Consequently, I am certainly not in the position to give you any advice regarding what should be done at this point in the estate administration to deal with the outstanding issues involving the estate income or property taxes or the potential sale of real estate owned by the estate.

Micah Ball admits that he is adverse to me, and yet he still claims he is representing his client. I would think almost anyone who had an attorney in this situation would want that attorney to help them get another $100,000 of tax free money. Please note that I was not asking him for advice. I was asking him to explain to his client how she could be much better off financially by agreeing to some sort of sale.

Summary Of Micah Ball Results for Carter Tankard Smith

Micah Ball costs Carter Tankard Smith not only costs his clients the $100,000 plus as mentioned above, but also cost his client the $100,000 dollars that I was willing to give Carter to avoid going to court, and whatever legal fees he charged. Somehow it never seemed to occur to my niece that the longer a court case goes on, the more her attorney would rack up in legal fees.